Looking for the best mortgage rates, A mortgage calculator is a wonderful place to start because it allows you to estimate your monthly housing payment and determine how much you can afford. Equipped with that information, you may focus your search for a home and locate the ideal mortgage, along with the most affordable rates.

You can use a mortgage calculator to get an idea of how much your monthly mortgage payments would be. Depending on your debt-to-income (DTI) ratio, work history, and credit score, lenders may give you a variety of mortgage options. You must have a very good or exceptional credit score in order to receive the best mortgage rates. Prior to applying for a mortgage, try to raise your credit score. Because the lender will be taking on less risk, borrowers who make larger down payments typically qualify for better interest rates.

Get the Best Rates by Using a Mortgage Calculator

The largest and most significant financial choice of your life may be purchasing a home, and financing the purchase will probably require a mortgage. Using a mortgage calculator is a useful first step as it calculates your monthly housing payment, which includes principal, interest, taxes, and insurance, or “PITI.” You can experiment with different situations using the estimate to get a reasonable pricing range for your house search. You must enter certain loan information in order to utilize a mortgage calculator, such as:

Home price: The amount paid to buy the house. The money you spend up advance to purchase a home is known as the down payment.

Loan term: How long you have to pay back the loan. Loan Interest rates, or APRs, are the price of borrowing money. Property taxes are the yearly taxes that your city, county, or municipality imposes on you as the owner of real estate.

Homeowners insurance: The yearly premium you pay to protect your house and personal property from natural catastrophes, theft, fire, personal responsibility lawsuits, and other covered risks. The monthly payment you make to your homeowners’ association to assist with the upkeep and enhancement of the properties within the association is known as the HOA fee. To find out how changing one or more factors would impact your monthly mortgage payment, mortgage interest, and the overall cost of the loan, it’s simple to do so and advised.

A shorter loan term, for instance, will result in higher payments but lower interest over the course of the loan.

Naturally, a higher interest rate will result in a higher monthly payment and, consequently, a higher total interest amount.

Mortgage Types

Your lender may offer a prime rate mortgage, a subprime mortgage, or a “Alt-A” mortgage, which is in between, depending on your credit score, work history, and debt-to-income (DTI) ratio. Let’s examine each in more detail: Prime Mortgages Lenders view prime borrowers as lower risk. Although the precise cut-off varies by lender, the Consumer Financial Protection Bureau (CFPB) states that these applicants normally have credit scores of at least 660.

In order to qualify for a prime mortgage, applicants must also make a sizable down payment, usually between 10% and 20%. The rationale behind this requirement is that having a stake in the outcome makes you less likely to default. The lowest interest rates are given to borrowers with higher credit scores and DTIs since they are generally considered to be less risky. Over the course of the loan, this can result in savings of tens of thousands of dollars.

Prime mortgages satisfy the quality requirements established by the Federal Home Loan Mortgage Corporation Freddie Mac and the Federal National Mortgage Association (Fannie Mae). These are the two government-backed companies that buy loans from original lenders to create a secondary market for house mortgages.

Mortgages that are Subprime

Borrowers with poorer credit ratings and FICO credit scores between 580 to 619 are eligible for subprime mortgages; however, the precise cutoff varies per lender. These loans have higher interest rates because lenders are taking on more risk. Subprime mortgages come in a variety of forms. The adjustable-rate mortgage (ARM), which charges a fixed “teaser rate” initially before switching to a floating rate plus margin for the rest of the loan, is the most popular.

30-year mortgage with a fixed interest rate for the first two years before being modified, is an example of an adjustable rate mortgage (ARM). Even though these loans frequently have a fair interest rate at first, the mortgage payments significantly rise when they move to the higher variable rate.

Mortgages from Alt-A

Between prime and subprime mortgages are alt-A mortgages, often known as alternative A-paper mortgages. One of the distinguishing features of an Alt-A mortgage is that it is usually a low-doc or no-doc loan, which means that the lender doesn’t need a lot of paperwork to verify a borrower’s assets, income, or expenses. Because both lenders and borrowers can inflate figures to obtain a larger mortgage (which means more money for the lender and more house for the borrower), this creates an opportunity for fraudulent mortgage activities.

Due to the ability of lenders and borrowers to inflate assets and/or income in order to qualify the borrower for a larger mortgage, they were actually dubbed “liar loans” following the subprime mortgage crisis of 2007–2008. Even though Alt-A borrowers usually have credit scores of at least 700, which is significantly better than the subprime lending cutoff, these loans frequently offer greater loan-to-value (LTV) ratios, more flexibility with regard to the borrower’s DTI, and relatively low down payments.

Because of these concessions, some borrowers are able to purchase more homes than they can afford, which raises the risk of default. However, if you do have a high income but are unable to prove it because you earn it irregularly for instance, if you work for yourself, low-doc and no-doc loans may be useful. Interest rates on Alt-A mortgages are often higher than prime mortgages but lower than subprime because they are considered to be slightly risky lying somewhere between prime and subprime.

Obtaining the Finest Mortgage Offer

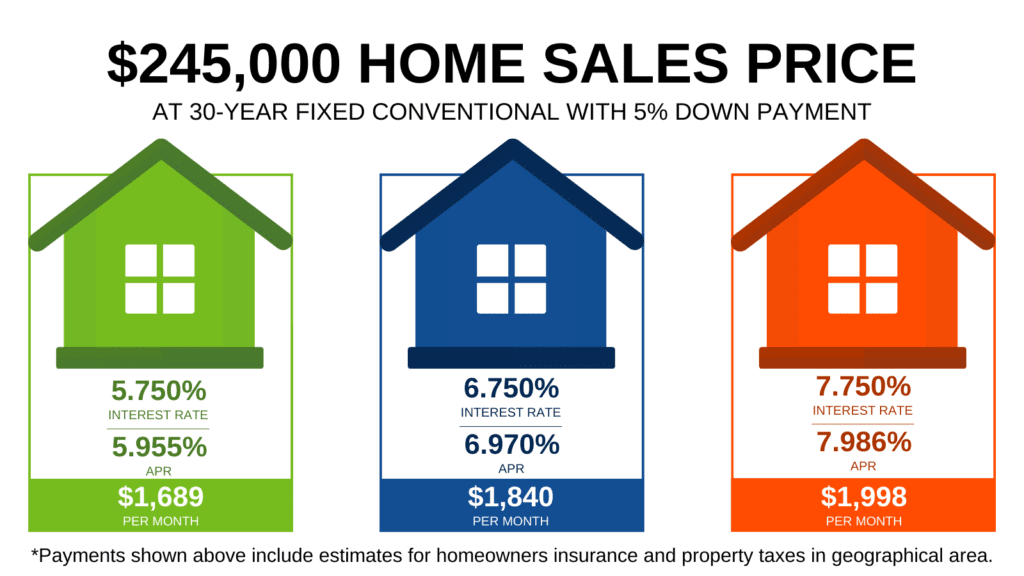

You pay more each month and, of course, pay more for your house overall if the interest rate is greater. Let’s examine a $200,000 30-year fixed-rate mortgage in order to assess the best mortgage rates. Your monthly payment would be $1,025 at the prime rate, which in this case would be 4.6%. You would actually repay $369,103 over the course of the loan, plus $169,103 in interest.

Imagine now that you are offered a subprime rate of 6% on the same $200,000 30-year fixed-rate mortgage. The total amount you would have to repay would be $431,676 after your monthly payment of $1,199 and interest of $231,676. That ostensibly minor interest rate change would set you back $62,573.

Although they could be competitive, lenders and mortgage brokers are typically not required to give you the best deal. Shopping around is certainly worth the effort. Over the duration of a loan, you can save tens of thousands of dollars by taking the time to look for a better interest rate.

How to Obtain a Lower Mortgage Price

Now is not the time to delegate your purchasing to someone else. As we just showed, the terms you receive can significantly impact the cost of borrowing the same amount of money. How can you keep your mortgage payments from going over budget. Of course, use your online mortgage calculator to analyze the offers you receive and determine the interest and payment amounts. Additionally, take the actions listed below when you go or even before you go.

Raise Your Credit Rating

It could be difficult to get your finances in order if you’re currently shopping for a house. So try to plan ahead; perhaps even put off looking for a home until you can get your financial house in order. Generally speaking, lenders will give you a greater interest rate if your credit is better. Therefore, make every effort to pay off credit card balances and other personal bills in order to raise your credit score.

Your rate could change by more than 0.25% even if your score differs by just 20 points. A quarter of a point might result in an additional $12,000 or more in interest payments over the course of the loan, or an additional $33 per month, on a $250,000 home.

Put Money Down for a Down Payment

You’ll pay less in interest over time and have a smaller mortgage payment if you can contribute more. A cheaper mortgage rate can even result from a larger down payment. For instance, offering a 30% down payment instead than the standard 20% could result in a rate reduction of more than 0.5%.

Compile Data on Your Earnings and Work Experience

In order to make sure you can afford your mortgage payments and eventually repay the loan, lenders often want to see two years of consistent job and income. Lenders want W-2 paperwork and your two most recent federal tax returns if you are a salaried employee in order to confirm your income. Additionally, lenders ask your company to confirm how long you have been employed there. Lenders are doubtful of your capacity to afford a mortgage if your income has decreased or if you have experienced job gaps in the past two years. You may also have problems obtaining a mortgage pre-approval.

In a similar vein, self-employed borrowers must complete additional requirements in order to obtain a mortgage. Expect to pay higher interest rates if you work for yourself than what you see online; those prices are for borrowers who are deemed more creditworthy due to their great credit scores and consistent, verifiable incomes.

Additionally, lenders typically have more stringent requirements for confirming income from self-employment. In addition to two years’ worth of federal tax returns, you will also need to provide a profit/loss statement, a signed declaration from an accountant, and other supporting evidence to demonstrate that your business is making enough money.

Understand Your Ratio of Debt to Income

How much debt you have compared to your gross monthly income is important to lenders. Lenders use your work and income history to determine your DTI. Your mortgage rate is largely determined by this computation. Compared to other loan types for self-employed borrowers, including a no-documentation loan or a stated income/stated asset loan, you will receive more favorable rates and terms if you can provide proof of your income for a full-documentation loan.

Lenders use two formulas to determine a borrower’s DTI, the “front-end ratio” and the “back-end ratio.” All monthly housing expenses (mortgage payment, homeowner’s insurance, property taxes, HOA dues, etc.) are combined to create the front-end ratio, also known as the housing ratio. After that, you divide this amount by your gross monthly revenue. The back-end ratio, also known as overall debt, is calculated by dividing the total amount of your monthly installment and revolving debts (such as student loans, auto loans, and credit cards) by your gross monthly income. It also includes the anticipated mortgage payment.

Lenders assume that a greater DTI indicates a higher likelihood of loan default when analyzing these ratios. Lenders often prefer to see a maximum back-end ratio of 36% and a front-end ratio of no more than 28%.

Employ a Calculator for Mortgages

A mortgage calculator uses the information you enter to determine how much your monthly payments might be. Investigate many options to determine the best mortgage for you, with monthly installments you can afford and interest rates you can tolerate overall. For instance, if you put a greater down payment on a 15-year mortgage, you may be able to afford higher payments.

Take Closing Costs and Interest Rates into Account

There are other factors to compare, but the interest rate is crucial. If you ever wish to refinance, will there be a prepayment penalty? How much does it cost to close? Typically, closing expenses range from 2% to 5% of the home’s purchase price. You should budget between $3,000 and $7,500 for expenses if your home is worth $150,000. It would be wise for you to find out what a lender usually charges because that is a wide variety.

Before you sign on the dotted line, you can review the actual figures on the loan estimate document that your lender provides.

Take into Account Private Mortgage Insurance

Closing expenses are a one-time expense, but they do go toward the total cost of your mortgage. However, another bite continues to sting. You can be compelled to carry private mortgage insurance (PMI) if your down payment is less than 20% since you are viewed as a higher risk.

For the lender, this makes you a safer option. The problem is that you are responsible for paying for it, which amounts to between 0.5% and 1% of the total loan amount annually. The cost of carrying the loan may increase by thousands of dollars as a result. Make sure to stop paying PMI as soon as you have enough equity in your home to qualify if you do have to.

Make a Decision

Suppose you land the best mortgage offer. Congrats, but hurry up. For a predetermined period of time, the interest rate and maybe other terms are fixed. You risk losing the deal if you don’t close inside the lock time. Avoid putting things off.

How Can the Lowest Mortgage Rate Be Obtained?

A minimum 20% down payment and a high credit score are prerequisites for obtaining the best mortgage rate. To find the greatest mortgage rate available right now, you will need to shop around and compare lenders.

Is It Time to Lock in My Mortgage Rate?

Several aspects of your financial status will determine if you wish to lock in your mortgage rate today. You should lock in your rate if you wish to remove the possibility of it increasing. However, you might not want to lock in your rate if you are willing to take a chance that it will drop in the future.

Can I Request a Rate Reduction from My Lender?

You can definitely ask your lender to reduce your mortgage interest rate because they are flexible to some extent. However, keep in mind that there can be additional fees involved in persuading your lender to accept a lower rate, such as paying mortgage points.

Conclusion

Long before you’re prepared to apply, the majority of the work required to obtain the best mortgage rate is completed. The greatest ways to reduce your rate are to have a large down payment and an excellent credit score. Compare, shop, and calculate your mortgage on your own. Additionally, keep in mind that you are not required to borrow that much money just because you are eligible for a particular amount mortgage.

One thought on “How to Look the Best Mortgage Rates 2025”