A house buyer can get a Federal Housing Administration (FHA loan) from an approved bank, credit union, or lender. Still, it is guaranteed by the US Department of Housing and Urban Development (HUD). Underwriting criteria for applicants may not be as low a credit score.

FHA loans have tiny down payments and standard approval requirements. They are prevalent for first-time homebuyers and target low to moderate-income families looking to become homeowners.

FHA Loans Operate

If your credit score is at least 580, you can borrow up to 96.5% of the home’s value with an FHA loan. This means you only need a 3.5% down payment on your loan! A credit score of 500 to 579 you can be approved with the standard minimum down payment of just over 3.5%.

A down payment can come from savings, a cash gift from a family member, or through Down Payment Assistance Awards on an FHA home loan.

The Process of an FHA Loan

The Federal Housing Administration does not issue loans to people who are buying a house. Instead, the loan is made by a bank or other financial organization approved to provide FHA loans. However, the FHA ensures the loans. That means the default risk is not on them, so it will be simpler for banks to bedside their approval. It has an FHA-insured loan for that reason. Although the premium is paid to the FHA, those who qualify for an FHA home loan must take out mortgage insurance. Bureau of Financial Protection for the Consumer.

The FHA Loan’s Past:

The Federal Housing Administration began during the Great Depression in 1934. The housing market was a mess foreclosures and defaults were rising, 50% down payments were often required, and regular people couldn’t afford mortgages. This led to a homeownership rate of just 10 percent, making the US, for all practical purposes, a rental nation.

Homeownership in the United States rose steadily once the government established the FHA (Federal Housing Administration) to provide more loan financing options, reduce lenders’ financial risk, and make it easier for borrowers to obtain home loans. There has been an increase in recent years when the rate stood at a record 69,2% — up from about 55 (%) -back home with their parents.13 This figure stood at 65.6% by mid-2024

Importance: FHA home loans are open to everyone and largely were for those who could not afford conventional mortgages, but their flexibility has opened the door of homeownership to people from diverse economic backgrounds.

Conventional loans are usually better for those with solid financials and good credit. In contrast, FHA loan benefits go more toward consumers with greater debt associated with a short period of time and prospective homeowners without enough savings to fund a higher down payment.

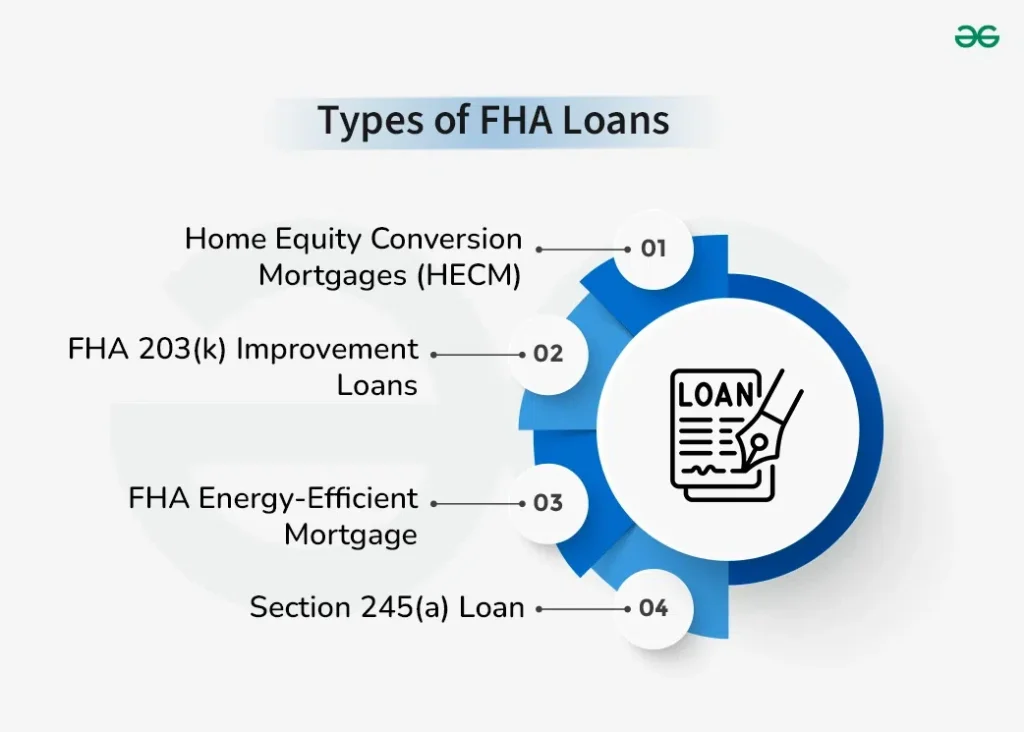

Additional FHA Loan Types:

The FHA offers a variety of home loan packages besides the standard fixed-rate product.

Home Equity Conversion Mortgage (HECM) Mortgage:

This reverse mortgage program allows homeowners age 62 or older to convert a portion of their home equity into cash while retaining the title. The homeowner can receive a portion of the money as cash or use all of it in a line of credit, as a lump sum payment, etc.

An FHA 203(k) Loan to Make Updates:

Some repairs and renovations are considered in the FHA home loan amount. This is great for people willing to invest sweat equity in their property and purchase a fixer-upper.

FHA Energy-Efficient Mortgage:

Like the FHA 203(k) improvement loan, this program is designed to improve your home—here, it’s through solar or wind energy systems and new insulation to reduce your utility bills.

Loan under Section 245(a):

This type of service is helpful for borrowers who expect to increase their income. GPM offers those with little money upfront smaller monthly payments that increase over time.

This increase is anticipated in the principal monthly payments on the Growing Equity Mortgage (GEM). Both of these result in shorter loan terms.

FHA Loan Requirements

Applying for any mortgage requires proving you meet typical guidelines, such as having a legal right to be in this country, being of retirement age per state laws, and providing verification that your Social Security number is valid.

While FHA lending guidelines are more forgiving on some things credit, cash to close, they quickly have their limits. But there are also more challenging requirements.

Your Credit Scores:

Federal Housing Administration loans are available to consumers with credit scores in the 500s. That is considered poor for a FICO score. 5 for a minimum down payment of 10 percent; if your credit score is between 500 and 579, you must put at least that much. If your credit score is 580 or above, an FHA loan lets you put down just 3.5%.

By comparison, those vying for a conventional mortgage must typically have at least a credit score of 620. The down payment required by most banks falls between 3% and 20%, depending on how freely they are willing to lend at the time of your application.

Debt Honoring History:

A lender will also examine the payment history from the prior two years pulled from your credit report. If permitted, the attorney general can conduct credit checks and refuse individuals who have not complied with satisfactory repayment plans for their federal student loans or taxes.

Most of the time, a borrower must have been past bankruptcy or foreclosure for at least two years and must reinstate their credit profile in good standing to be eligible for an FHA loan or any mortgage. Exemptions from this requirement are allowed in cases where the borrower had mitigating circumstances, such as an extended illness.

Proof of Steady Work History:

Because mortgages require repayment, the FHA-approved lender will want to see proof before aligning himself with a future borrower. The recent and stable employment of the borrower is also a primary consideration when judging if they can meet their obligation.

You can have pay stubs and tax returns to verify your income for these claims. If you worked in the same or related field and sent income tax returns for two years before becoming self-employed, you can become eligible, even if you have worked less than two but more than a year.

Enough Money:

Usually, your monthly mortgage payments principal and interest, property taxes, homeowners’ insurance, and mortgage insurance premiums must be at most 31% of your gross income. Banks call this the front-end ratio.

Combined with your other monthly consumer bills, such as auto or student loans, your mortgage payment can represent no more than 43% of your gross income the back-end ratio.

Which Houses Qualify for FHA Loans:

Usually, the home you want to finance has to be owner-occupied and your primary residence. In other words, the Federal Housing Administration program is not intended for rental or investment properties. FHA-insured loans are available for townhomes, row houses, condos, and single-family detached or semi-detached homes in FHA-approved condominium developments.

You may also be asked to obtain a property appraisal from an FHA home loan-approved appraiser for the home you want to buy and meet specific minimum requirements. An uninsurable home is so disrepair that it doesn’t meet HUD standards.

If the seller declines to make the necessary corrections and your house does not meet these standards, you will be responsible at closing for being forced to pay everyday penalties. In this example, the money is held in escrow until you make those repairs.

The Federal Housing Administration Loan Limits

It caps the amount you can borrow at significantly lower figures than most traditional mortgages. This is state-specific, but it will have a lower cap in less expensive areas and a higher cap if you are located somewhere more expensive.

Those limits for 2024 range from $498,257 to $1,149,825—known as the FHA’s “floor” and “ceiling.” Some high-cost areas, known as “special exception” areas, are Alaska, Hawaii, Guam, and the U.S. Virgin Islands, where very high building costs make most new home construction affordable.

If you live in an area with higher housing costs, the maximum may be as high as 115% above your county’s median house price, according to the U.S. Department of Housing and Urban Development (HUD).

Federal Housing Administration (FHA) Loan Relief

If you run into a legitimate financial hardship, such as if the cost of living increases or suddenly your bonus job is gone, an FHA home loan will allow relief. The FHA, for example, provides several forbearance plans under which you can temporarily halt or reduce your mortgage payments.

Another initiative the Federal Housing Administration implemented was the Home Affordable Modification Program (HAMP), which “permanently reduces monthly mortgage payments to an economical level for 2 million at-risk homeowners.” However, the program is “suspended” until April 30th, 2025.

Not all properties qualify

If you get an FHA home loan from a private lender, such as a bank or credit union, we assume that you fully understand how to qualify for the loan. Most banks and mortgage lenders service FHA Loans.

However, FHA loans typically have higher interest rates and require borrowers to pay upfront plus monthly mortgage insurance payments since FHA loans are intended for riskier folks. FHA home loans come with borrowing caps and are meant only for your primary residence.

How to apply for an FHA loan

You can directly apply with a bank or other lender for the funds to use and the property you want through an FHA home loan. Almost every bank and mortgage lender in the US approves Federal Housing Administration loans.

Within a day or two after you apply, your lender will have all the financials to pre-approve any FHA loan options. By doing this, you can have a sense of approval to lend before actually committing anything.

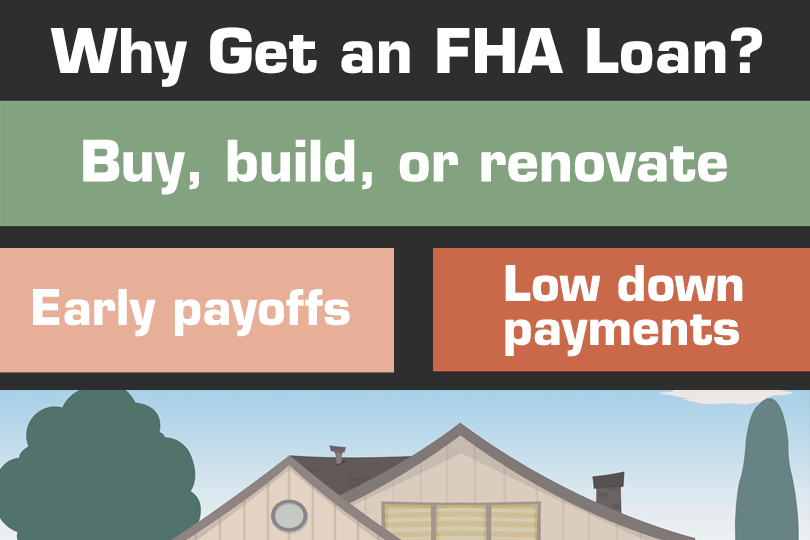

Pros and Cons of FHA Loans

FHA Mortgages FHA home loans are frequently the best mortgage option for individuals who cannot afford financing with private lenders. They can seek FHA financing with higher debt (aka more debt to income) and possibly a lower credit score.

FHA Loan Pros:

- For borrowers with terrible credit.

- Smaller down payments.

- Federally backed.

FHA Loan Cons:

- Insurance is paid upfront and every month.

- Second homes or investment properties aren’t allowed.

- Higher interest rates.

how much you can borrow by area

The costly local render one particular family member with inadequate acquiring potential a maximum home loan of all-around $1.149m or so by 2024, although the higher dependent prices also lend you up to $498,257 above which for some fast worth peat regions in more significant price states.

FHA Mortgage Insurance Cost

FHA home loan annual premium Paid monthly with the mortgage PLUS another up-front payment that can be rolled into the loan

A Sept of the Amount Loan

PMI Premiums The amount of an adjustable-rate mortgage PMI premium depends on the sum of your upfront and annual payment and whether it’s term, score, or type-and-loan-to-value.

The numbers can be entered into an FHA home loan calculator, which is available online. So, for that $400 two-year FHA loan at 7.125%, the monthly payment would jump to $2,600 plus mortgage insurance of around S$176.

Remove my FHA Mortgage Insurance

It requires mortgage insurance payments for the entire duration or 11 years. The only way to eliminate them before the end of your 30-year mortgage is by refinancing with a non-FHA home loan.

If so, you would be fully paying off your FHA loan. But if the house has more than 80% equity, you might never pay private mortgage insurance (PMI) again.

You can get another FHA loan

There are a few programs and refinance options, particularly for loans backed by the FHA home loan or lenders approved by the Federal Housing Authority.

FHA loans are also not without their drawbacks:

These loans might require you to carry mortgage insurance for the term of your loan even if your initial GVR was below or will be below 80% and often come with higher interest rates than conventional mortgages. But, you can only qualify for a relatively small loan when using an FHA home loan.

Conclusion:

They are unlikely to get the chance to own a home other than Federal Housing Administration loans because they cannot otherwise qualify for traditional bank mortgages without 20% down and having too bad credit through bankruptcy or poor scores. However, a conventional mortgage from the best lenders might be more advantageous for borrowers who put down a lot. In addition to moving you out of the FHA home loan, the reduced fee will make it easier for borrowers with less than a 20% down payment to get a fixed-rate loan elsewhere instead of having monthly mortgage insurance payments tacked onto their payment on an FHA home loan.

1 thought on “Federal Housing Administration (FHA) Loan”