Another possibility is if you meet qualifying standards, have a home, and have an FHA loan refinance cash out with an FHA loan. For starters, you need to have lived in the home for at least 12 months and been current on your mortgage payments, assuming that the value of your house is more significant than what remains due on the mortgage. Gold credit, in the context of GOLD, applies to lenders and satisfies lender topic SP Score requirements for valid eligibility candidates.

If you have made significant progress paying down your mortgage and are, therefore, sitting on more equity, or if the value of your home has risen substantially since purchase, a cash-out refinance may be applicable. The new loan will be a cash-out refinance and could have an altered interest rate or term. A cash-out refinance increases your monthly payment and mortgage loan balance.

How Work FHA Loan Refinance

At this juncture, if and when you have positive equity in the position, then perhaps an FHA cash-out refinance loan can be your deal saver, especially since bills are pending with unpaid hoards of reminders. Equity is money beyond what remains to be paid on your first loan, three or more. And when I say your dollars, don’t read the blue hole on them; you can spend them like free checking.

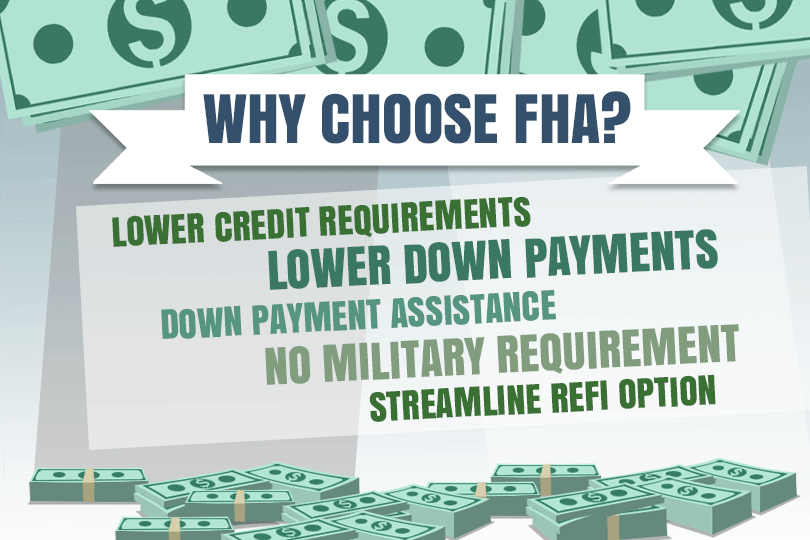

FHA Loan Refinance are for borrowers with FHA mortgages and 12 months of verifiable ownership or more. They are FHA-insured, and the Federal Housing Administration regulates them quite heavily. With government sponsorship, this program may offer a better rate than other mortgage refinance options, even if you have an imperfect credit score.

Loan Value of 80%

Say your lender will let you borrow 80% of your home is worth financial Details of your Cash-Out Refinance.

- New loan: $240,000 ($300,000 home value LTV) 80 loan-to-value)

- These loans then split would be allocated as.

- Cash out the $100K and pay off the existing mortgage loan.

- Get a single cheque for $140,000.

Thus, the new mortgage loan of $240,000 incorporates the remaining balance on the original loan $100k with the cash you received $140k.

Locate Lenders

Borrowers should approach a lender to engage with them on a cash-out refinance. In this process, the lender evaluates the terms of an existing mortgage, the amount owed to repay the loan, and the borrower’s credit history. The lender will then use an underwriting analysis to make their offer.

The loan is refinanced with a new monthly payment structure, and the borrower takes out another loan to pay off the old one. The householder gets a cash payment for the amount above and beyond the mortgage payoff.

Equity Reduce

A FHA Loan Refinance shrinks the equity in your home and blows up your mortgage loan balance. The lender is taking on greater risk, so the closing costs and fees with such a refinancing can be higher than for an ordinary refinance.

Debtors often pay lower fees and interest rates with cash-out loans from the U.S. Department of Veterans Affairs (VA), which specializes in mortgage refinancing, than non-VA loans based on specialty mortgages.

Loan appeared first on EMC Lending

However, you can still use an FHA Loan Refinance if you are not interested in refinancing existing home loans in the form of a mortgage.

However you need to fit specific criteria

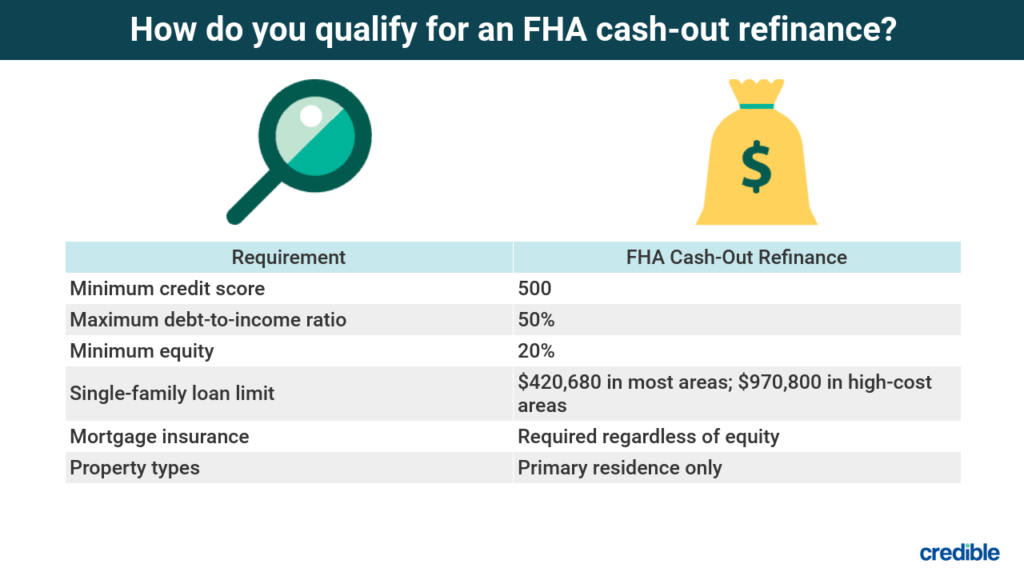

Only owner-occupied primary residences are considered for FHA Loan Refinance. Second homes and investment properties are also excluded. You must have owned the house for at least 12 months before moving.

History of on time mortgage payments

Your past year’s monthly housing costs via your refinance must demonstrate a payment record without even one late charge. You should have a credit score of 500 to be eligible for the FHA loan. Some FHA-approved lenders require scores of at least 640. Generally, the better your credit score is 660 and above the lower you can likely get cheap interest rates.

Get an FHA Cash-Out Refinance Loan

Then, find an FHA-approved lender who will give you a FHA Loan Refinance on your house. Remember that the loan must be below 80% of the value the property would obtain after full rehabilitation. Moreover, you should maintain 20% equity in your home after refinance. This limits the cash you can take out of your equity.

Before determining how much cash you can receive, the first step is deciding what your home assesses today. You can make a rough guesstimation by checking with a local real estate agent, looking up recent sales of comparable homes in the neighborhood, or hiring an appraiser to give you a more precise quotation.

You can discover how much equity you have by peering at your mortgage statement or mortgage amortization table. These tables show precisely what each month has taken off the balance, thus costing nothing more.

The $200,000 will pay off the other half of the original mortgage, leaving you with an extra $50k. As on other home mortgages, the closing costs on FHA Loan Refinance will lower the amount you take out of them. Suppose you had typical FHA loan expenses at $6,868 (the median for the category), which leaves $43,132.

Pros and Cons of the FHA Cash-Out Refinance Loan

If you have decided that an FHA Loan Refinance is the best course of action. Locate an FHA approved lender near you using the U.S. Department of Housing and Urban Development’s database. Yet before submitting your application, you must evaluate the risks and possible benefits of an FHA cash-out refinance loan compared to other borrowing alternatives.

Advantages:

- Low rates of interest.

- Minimums for terrible credit scores.

- Greater loan amounts.

Drawbacks:

- A rise in debt.

- Your house is in danger.

- Closing expenses and fees.

Prose Described

FHA Loans have low interest rates: As of September 2024, FHA loans generally possess an excellent interest rate, which is billed at only about 6.1% in most cases. They are among the cheapest types of debt to borrow and compare favorably with other types of consumer debt, such as credit cards or personal loans.

FHA loans typically have lower credit standards than many other types of financing. And you can even qualify for a loan with a first rate as low as 500. A cash-out refinance allows you to get a higher maximum cash amount than other options, such as personal loans or lines of credit, because it is based on the equity in your home.

Cons Described

Choose a FHA Loan Refinance or home equity loan to pay your way, which will be included in the new amount owed. Therefore, they are bound to charge more monthly, making them safer if you lose your job or need help with a financial emergency for both reasons. It depends on when I purchased my first housekeeping bill home.

Send us an email, and we can connect this request for any other people interested in payday loans. With an FHA cash-out refinance loan, you must pay closing charges these add up to thousands of dollars that you could have otherwise used. They can come with higher interest rates, but other forms of borrowing have even lower costs.

FHA Cash Out Refinance Loan Explained

The FHA cash-out refinance loan allows you to do the same thing with a larger mortgage and receive that extra amount in rundowns. Then you can spend what money is left of yours.

Borrowing money to remodel your home might be cost-effective for significant expenses with FHA cash-out refinance loans or an alternative mortgage.

The only big deal is that borrowing more on the mortgage sets off a debt trigger. This could mean an increase in monthly mortgage repayments that makes the load challenging to bear should you lose one or more jobs (or sources of income). Or even lose your house (if the lender forecloses)

FHA Cash-Out Refinance Loan Limits

Can I borrow up to 80% of what my home is worth? If your house is worth $300,000, for example, the maximum they will lend you may be around $240,000. The rest of the money might be paid in cash only after your current mortgage is discharged.

So, if you took $240k as your original loan and you still have a $140 (current balance from existing mortgage, that leaves another $100 “cash out.”

Conclusion

If you have a big purchase to finance, an FHA Loan Refinance can be one of the best and most affordable ways to borrow money against your home’s value. But monthly mortgage payments at a higher rate could push your finances to the limit.

One thought on “FHA Loan Refinance Cash Out”