You might be able to change your house’s equity into retirement income through a Reverse Mortgage Age. Both are good for those retirees who have either almost paid off their mortgage or own it outright. Another native institution is HECM, which offers a reverse mortgage to those at least 55. These proprietary loans open more doors for homeowners who do not meet the HECM age requirements but want to use a piece of their home equity.

Thus, consider it a play to get access to your household equity so that you can provide for yourself in retirement if you already have a good idea of the reverse Mortgage Age and HECM age orders.

Important lessons learned

A reverse mortgage is a financial product designed for homeowners. With it, the homeowner can access real estate equity and receive payments to fund retirement or other large purchases.

- You can download our information flyers aimed at older homeowners on developing a retirement income by drawing upon equity in their homes.

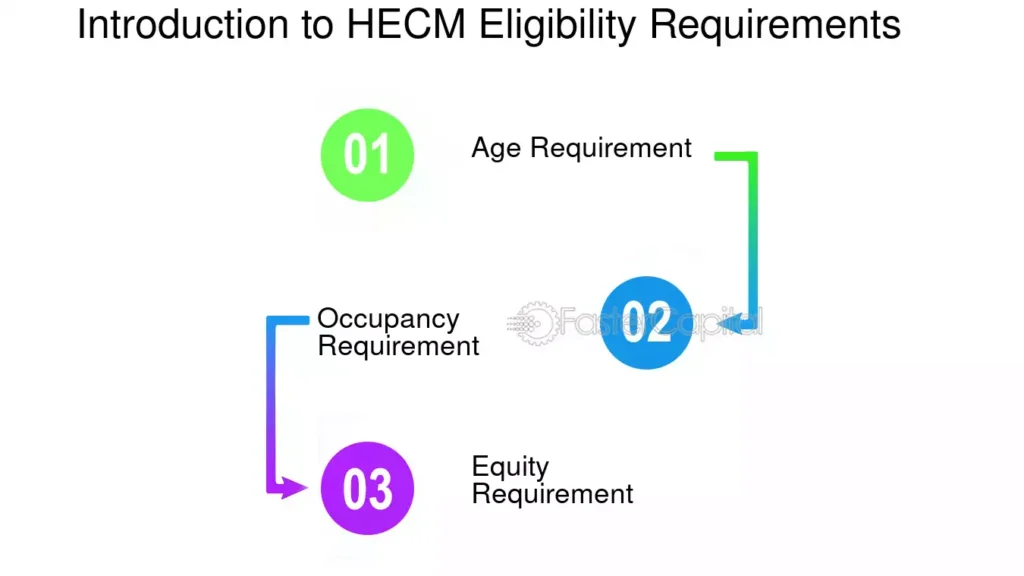

- You must be at least 62, as you will make the case if it is a good fit for an HECM, the only reverse mortgage issued by the federal government.

- Reverse mortgage lenders who handle non-HECM loans have perhaps been known to offer these products to borrowers younger than 62.

- If a spouse is under 62, the HECM can be assigned as an “eligible non-borrowing spouse.

This will allow them to use the money to pay off debt, medical bills, or living expenses. This may sound a lot like a home equity loan or line of credit, but it isn’t quite the same thing.

Basics of Reverse Mortgages

You can check out our Reverse Mortgage Cost page for a homeowner of Reverse Mortgage Age who wants to apply for their house here. This income could be taken as a line of credit, in one lump sum or regular payments.

From there, they can use this money to pay down debts or other medical bills or catch up on important living expenses. Despite what the name suggests, this is not a home equity loan or a HELOC. This is the opposite of a traditional mortgage, where payments are made by a homeowner back to the bank. The reverse mortgage compounds interest and fees on the unpaid balance. No more payments will be due on that outstanding amount until the homeowner ceases to use it as their primary residence.

When you take out these loans, they remain attached to your house and are accompanied by monthly payments that will often last for the rest of your life. LEFT values are ONLY for fixed rates A lender. A Fixed might offer a 30-year Fixed-rate mortgage along with an ARM. HECMs Home Equity Conversion Mortgages are federally insured reverse mortgage products. These programs feature stringent approval criteria, such as an age minimum.

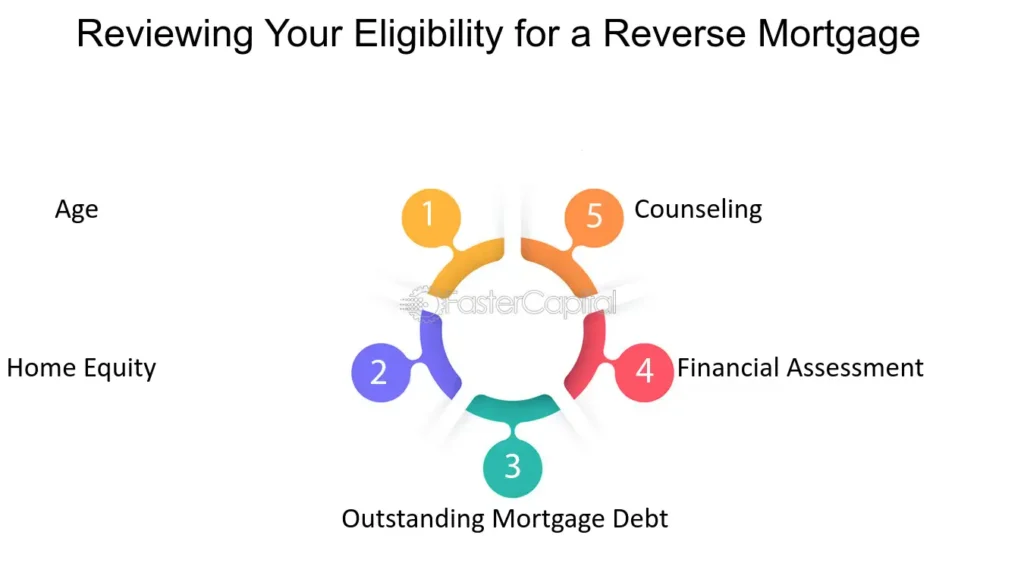

Reverse Mortgage Age Eligibility

Reverse Mortgages work for those who have paid their residences off entirely or have quite big equity in their Reverse Mortgage Agents. Generally, these are homeowners who have retired or are nearing retirement age. The HECM program is also age-neutral in that no upper limit applies, as there is with most other mortgage or financial products. Many people must be of retirement age and meet other requirements to qualify for a HECM. Owners of homes must:

- Declare it as your legal home.

- They own their home primarily or outright.

- Pay down Your Federal Loan Unmissed

Show proof of financial capacity to maintain the home, pay for insurance, and pay property taxes. You will also need some good equity in the house, as you have to own most of the mortgage paid off and a nice chunk of it outright just so they can secure this from their end. After loan closing, you need to bring your existing mortgage balance up to date. Other obligations linked to your home, such as Home Equity Loans or Lines of Credit (HELOCs), are probably going to be paid off, too.

Keep their home in order

The home must also fall within the list of four good or property types: approved single-family homes, FHA-approved condos, manufactured homes eligible for FHA, and two-to-four-unit multiunit properties where one is occupied by a borrower. Although there may be programs like Reverse Mortgage Age 55 or even Poll Fee Annuity Age 60, none of these house loans will likely be backed by the Federal government.

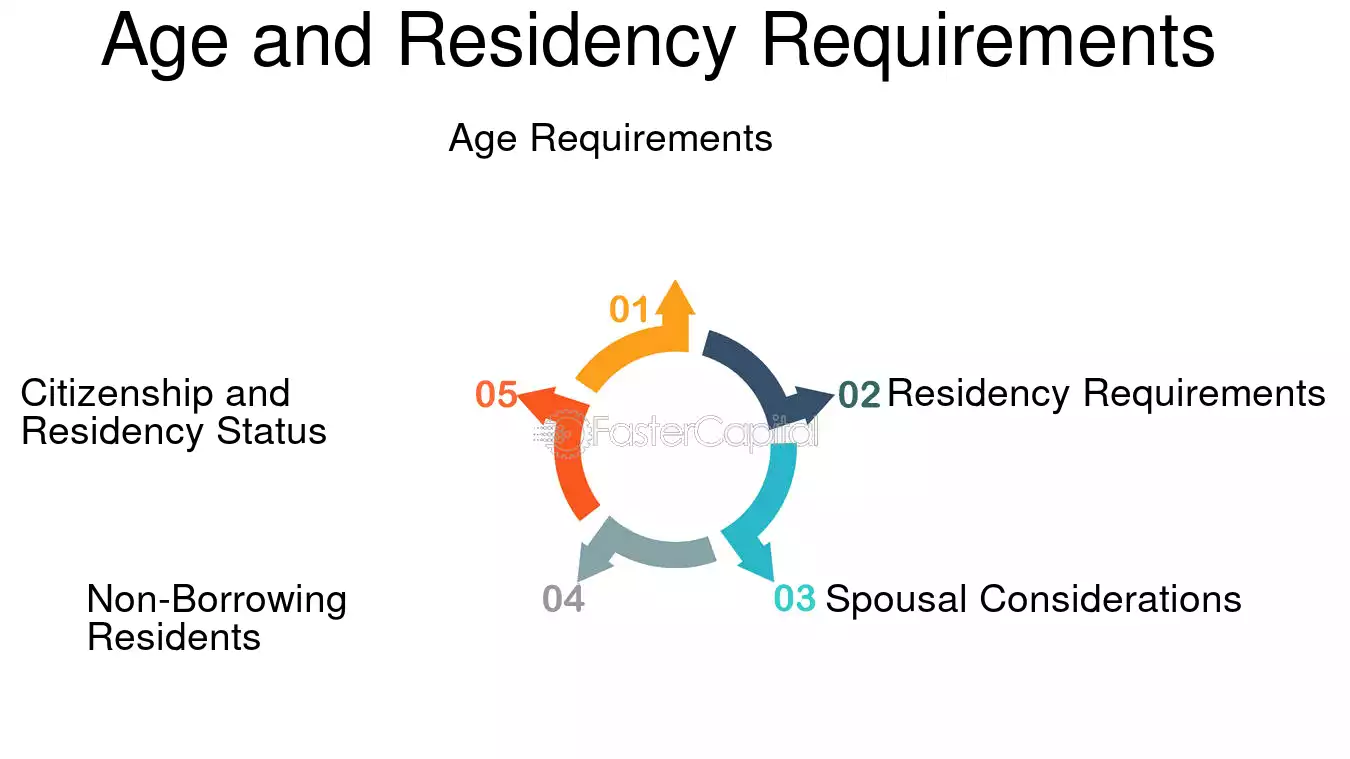

64 Non-Borrowing Spouse Under 62

It is a possible barrier for married couples applying through the HECM program. If one of the spouses is 62 or older and the other isn’t, then it may still be possible for at least part of an HECM to happen, but unfortunately, that reverse mortgage cannot be named as a co-borrower on that loan.

They will still qualify as an eligible Nonborrowing Spouse. However, that could later become a big problem, particularly if the borrowing spouse dies before her or his husband. Reverse Mortgage Age loan documentation defines (for all intents and purposes) an eligible non-borrowing spouse, although they are never listed as a borrower.

To be eligible, the applicant must have been married to the borrower at the time the reverse mortgage was originally executed and remain the spouse of the borrower for life by continuing to live in her primary residence. You are also still eligible for non-borrowing, regardless of the age difference between you and your spouse even if you’re just five or ten years younger than them. You must be married to the borrower, living in the home, and on their loan paperwork. You are regarded as an ineligible non-borrowing spouse if you cannot meet these requirements.

A key difference is that if you’re designated an eligible non-borrowing spouse, it’s your home for life. What remains of your HECM balance is never repayable, but you are still responsible for property taxes and homeowner insurance.

Can I Borrow HECM Reverse Mortgage

Reverse Mortgage Age Proceeds are available as a Flat sum of money, monthly term or tenure payments, or a line of credit payment plan. The money can be used for groceries, utility bills, or medication.

How Much Money You Can Receive in a Reverse Mortgage Several things will determine how much money you may get with your reverse mortgage.

Current Interest Rates

First, there is the issue of age; this plays a critical role in that you are eligible for more money if you apply at an older age. That can be anything from principal limit variables loading higher than otherwise, and when you Reverse Mortgage Age it instantaneously goes stratospheric, giving you more money. Homeowners owning their own home:

- Your home value divided by the LTV percentage will give you your loan amounts.

- age 70 & $2,000,000 value is LTV of 35.6% or loan amount = $712K

Reverse Mortgage Implemented for Seniors

Homeowners who are 55 but under the required qualification age for an FHA reverse offer can utilize Reverse Mortgage Age alternates through “Jumbo” or “Proprietary Programs.” No mortgage insurance is needed because these are not HUD-insured loans like HECMs. However, the property requirements and eligibility rules may vary slightly from one HECM program to another, and they also frequently overlap.

Which Age to Get a Reverse Mortgage

No month to month payment as long as you remain in your home. The reverse mortgage also called a house equity conversion home loan (HECM), works on the facility you can obtain without regular monthly repayment for as long as you live.

To be eligible for an HECM, at least one borrower must be 62+ and can defer the loan until they no longer use it. A HECM can also include a limited loan and a non-borrowing spouse (NBS) under 62 years old. This is all but impossible reverse mortgages that aren’t HECM can lower their age policy cap below 62 but nothing stops them from doing it.

Get Everyone’s Reverse Mortgages

No to apply for a HECM, you must live in the house as your main residence and be 62 or older. You are also expected to make 50 percent of the loan payment. In the most general sense, you must be the owner of a home with 50% or more equity(Return clear).

The Final Word

The age Reverse mortgage primer: If you are under 62, an HECM is not an option. On the flip side, for other age selections on a Reverse Mortgage Age, however, you could borrow money if advantageous. The catch is that the non-government-backed mortgage must originate from mainstream lenders. Spend time studying the top Reverse Mortgage Age lenders before determining whether or not to move forward using a reverse home loan. Just know what you’re signing by Reading the fine print. However, some predatory lenders provide services to the elderly and take advantage of them.

One thought on “Reverse Mortgage Age Requirements”